Are you running a small business? Do you want to give your customers the option to pay your invoices by credit or debit card? Well why not, after all we're well into the 21st century now, but before you sign on the dotted line for either PayPal or Nochex, read on to find my experience on the ineptitude of the former, and the pocketing of my hard earned cash by the latter, then go take a look at Worldpay or SumUp who are leagues better than both!

You’d think that in this day and age it would be a simple business for a tradesperson to be able to offer card payment services to customers for their convenience in settling an invoice, but the banks aren't any help, so you’re forced to use the likes of PayPal and Nochex... however from my experience, they'll treat you like a fraudster.

Actually, it’s obviously not true that the banks don’t provide merchant services because they do of course, but they’re only interested in retail and they charge an arm and a leg for it. For someone like me who generally receives payments via either bank transfer, cash or cheque for a relatively low number of transactions per week, the banks are uninterested, so I ended up shopping around for a company who can provide the merchant services link between a bank and a small outfit like mine.

PayPal is arguably the best-known brand to the man-on-the-street for providing this service, so it’s them I first went to when I set up online payments though this website back in May 2016. Unfortunately, PayPal have a reputation for poor customer service and my experience with their business arm was no exception. My PayPal account came under threat of restriction in early October because they said I hadn't submitted all the information they needed in order to prove I’m not a money laundering scoundrel of some kind. The trouble was, I had submitted what they had asked for, twice in fact, but despite opening a support case, they couldn't or wouldn't acknowledge the problem and in the end my account was duly shackled in irons.

My PayPal portal claims I need to submit a Letter of Authorisation which I have done, twice, but their support people tell me the account is iced because they require the Beneficial Owner Declaration. They've sent steps on how to provide that information, but because my portal has a green tick showing that I have already submitted that too, the steps they've sent me don't work!

My PayPal portal claims I need to submit a Letter of Authorisation which I have done, twice, but their support people tell me the account is iced because they require the Beneficial Owner Declaration. They've sent steps on how to provide that information, but because my portal has a green tick showing that I have already submitted that too, the steps they've sent me don't work!

PayPal's tech support did what PayPal's tech support have a reputation for doing:- absolutely bugger all. Despite having an open case and them saying it would be reviewed by their Business Account Specialists, nothing ever happened and it remains in limbo today, five months later. Every time I log in, I'm told "some account information is missing or incorrect", but there's nothing I can do about it as my portal says I have already submitted the missing data. I can't even close the bloody account, nor will it let me email Support again ("Something went wrong" it tells me uselessly).

Besides the woeful lack of technical support which proves this is not a business grade product, PayPal has traditional associations with awful tat-bazaar site eBay and isn't really what I want to present as a professional payment interface to my customers, so in early November I switched this site to Nochex, fooled as I was with promises of great customer service from this British based firm. I mean, look at all the claims their website makes...

Sounds ideal!

Great! Something PayPal can't offer!

Wow! She looks positively overjoyed with the service she's getting!

This smart chap is so laid back because his buisness uses Nochex! I wanna be just like him!

Sign me up!

On hand payment experts, simple website integration, the right solution for me – how can things possibly go tits-up with Nochex?!

Nochex Tom, the sales-borg who signs you up and duly trousers your fifty quid joining fee, yeah - that's a thing, before he disappears forever, asked me what my average transaction value would be when I opened the account. Well, let’s state a value of £300 – not a figure plucked out of the air, but one based on PayPal receipts from May to October and, in fact, the average invoice amount based on all invoices issued in October and November of 2016.

Now, I don’t tell my customers how they should pay their invoices, although I do state on them that I prefer BACS, but any or all of the invoices I fling out for completed work could potentially be paid by credit or debit card via my payment processor of choice. Was an average payment of £300 an accurate figure for me to have given Tom? Sure – well, it’s bound to fluctuate, after all, it is an average, but it’s not like I'm suddenly starting to take million pound payments.

Nochex accepted the £300 average payment figure and told me I could take payments of up to £1500, but £500 would be retained in the account in case of chargebacks and there would be a 10% rolling reserve month on month. Their fee per transaction was 2.9% + 20p and they charged me fifty quid for the privilege of becoming their customer. I was fine with all this. It’s all more than PayPal were charging, and PayPal has no retention or reserve, but PayPal aren’t sorting out my account and I want a business-grade payment processing firm I can talk to.

From 20th November to 12th December 2016, four invoices were paid via Nochex to the values of £1500, £195, £1264.32 and £182.64 - an average of £785.49. The two larger transactions as well as the £182.64 were from the same customer as part of a larger job (first fix rewire, then second fix rewire), but all invoiced separately for different aspects of work performed on different days. Large jobs are necessarily dealt with in staged payments, but I don’t ask for deposits or take payment until the agreed portion of work is done so that a client can always see where their money is going.

In this case, the client wanted to pay his £2104.93 bill via card, but Nochex had a transaction ceiling of £1500, so he chose to settle the bill between a card payment and BACS, although I hadn’t advised him to do so and would rather have received the payment in full via BACS to minimise my transaction costs. But again, when an invoice is out in the wild, it's up to the client to decide on their preferred method of payment.

Alarm bells started ringing early on when I found I couldn’t withdraw received funds from Nochex to my business bank account because my Nochex account was still ‘under review’ by the Administration department. It took over a week from me logging the issue with their business-smart 24/hour super support people to being able to actually transfer any money out.

Four days later, I logged in to Nochex to find this message on my Withdrawl page:

Hang on, an ‘agreed retention’ of £1000? I thought it was £500?! Let’s just check Tom’s terms:

Well, there it is. It seems the agreed retention differs from the agreed terms that I agreed to! When I asked them why the goalposts had been moved, I received the following flannel:

I didn’t understand this as I wasn’t taking card payments three years ago, I’d only been set up for online payments via PayPal since May. I do have a Payleven chip & pin terminal that I picked up in 2014, but I don’t use it as there’s never a data signal when you need it in rural Warwickshire, and besides, I rarely bill anyone there and then, the invoice is processed by back-office software later and then posted or emailed out. I don’t know where they got the £1100 figure as being from three years ago, although a transaction for that value had been made through PayPal two months earlier in October 2016.

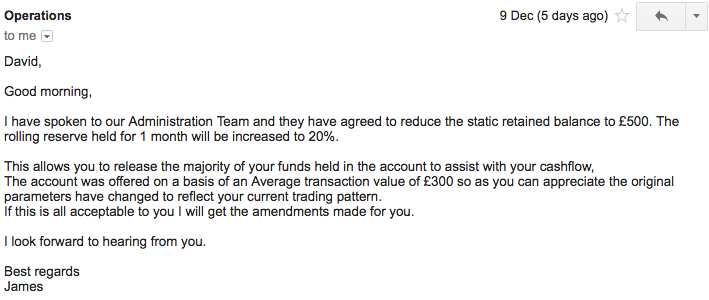

So I queried it and was told that the Administration Department had decided that the limit could be dropped back to £500, but now with a 20% rolling reserve instead of the agreed 10%:

Now, I must admit, it was a busy time just before Christmas and I didn’t notice the sentence which requested me to confirm I was happy with the new arrangement, so I assumed it had taken effect. Three working days later at 09:28 while I was on site up a ladder I received this request for a response:

Figuring I’d answer when back at the office later, I was still up the same ladder just 99 minutes later, when I got this bullet:

"A Nochex account is not suited to this business model?" What, my standard service industry business model? One where I provide a service, invoice the customer and get paid for it? And what do they mean by 'split payments'? The three invoices paid by one client were separate invoices for different set pieces of work performed on different dates. I get a lot of repeat business, and if Joe Bloggs pays by card for the first job, then he’ll likely also pay by card for a second or third job, so why should that cause panic for the payment processor?

I was left immediately unable to log in, and without access to the funds that were in there. Incidentally, despite chasing for withdrawls to be enabled and questioning the retention value, Nochex had seemed so spooked by the transactions received that only £195 had been withdrawn to date to my business bank account. I had left the balance of £1450.44 (after Nochex fees) in place as a goodwill gesture to show I wasn’t somehow trying to run off with my own money!

But that was it. After just four transactions in about as many weeks, they had terminated the service. And yes, they did keep their fees along with my fifty-quid set up charge for this shambles of a service. Incidentally, Nochex also retained the January rolling reserve and didn’t hand it back until I chased them in February. Maybe they hoped I’d forget about it?

In a baffling misunderstanding of just why I had opened a Nochex account in the first place, James, the moron in Operations, actually said to me on the phone that I'd be "better off" being paid by cheque or BACS because the fees would be lower! Well no shit son! You really don't want my business do you?!

At no point did Nochex proactively express any concerns to me about the account or the kind of payments being made, they just provided knee-jerk reactions and waited for me to notice. It was never actually explained just what they didn't like about an electrician's invoices for completed work being paid for by an end-client's flexible friend. Even now, I don't know what their problem was.

Just to add insult to injury, a quick moan on Twitter brought up this stooge with his ha-ha-hilarious avatar and childlike writing style:

He then posted this reply which he quickly deleted, presumably because he didn’t want it to appear in this blog, but in a possible misunderstanding of technology perhaps endemic at Nochex, Twitter had already emailed it to me.

Disclosure? What exactly hadn't been disclosed to Tom when I opened the Nochex account? I told them what I did, why I wanted the account and what the expected average transaction was. The account should either have been set up to suit, or they should have disclosed to me that they were unfit for purpose instead of robbing £50 out of my virtual wallet!

I still don’t understand what went wrong here. Nochex have never explained the issue. Yes, the average transaction value was higher than expected, and one particular customer chose to pay three outstanding invoices by card, but I’ve no control over which of the accepted payment methods any of my customers will choose to use for any given invoice. Besides, how can you work out what a long term average card transaction value will be when only four card transactions have been taken in as many weeks? Until I introduce a payment by card service, I don't know how popular it will be.

When I set up the account I was asked about the highest transaction previously taken by card, and that happened to be £1140.40 in the short time I was with PayPal, but generally you expect card payments for the smaller jobs where cash perhaps isn’t to hand and cheques are a faff. Had Nochex held out for longer, then smaller payments for the £60 jobs would inevitably have come in and brought the average back down. If the value of the received transactions was too high for them, then why did they bother to set a £1500 limit on the account? Why didn’t they contact me with their concerns? I could have made it clear on the invoices and website that card payments only up to £300 were accepted if they had told me there were fears so critical that it would warrant immediate account closure.

Nochex acted like they thought I was up to something incredibly dodgy, but all I wanted was to give my clients a more convenient way for them to pay!

Thankfully, I shopped around further and came across WorldPay – and don’t I just wish I had found them in the first place! So much simpler, no joining fee, no rolling reserve, funds paid in full to my business account three working days after receipt, direct debit billing for their charges, much easier to show on the company accounts exactly where the money is and their fees are lower. It really is So. Much. Easier.

Wishing to avoid the same sort of issue with Worldpay, and following on from the Twitter stooge's deleted advice for 'disclosure' with my new payment provider, I explained to Worldpay that Nochex had kicked me out for the four transactions received and asked if they would have had a problem with my business in any way. The chap I spoke to couldn’t understand Nochex’s position, and in fact had never even heard of Nochex. And doesn’t that say it all? If Nochex want to be any more than a British bottom feeder in a wide world of business finance, then they need to work on their communications. And their customer service. And their fee structure.

Me when asked if I accept PayPal or Nochex:

Only joking. Nobody ever asks!

Until then, if you’re a small business wishing to take plastic payments, take it from me that WorldPay or SumUp will charge you less, be simpler to account for and won’t pull out the rug from under you just because your customers are having the barefaced front to actually use the service they provide!

So, if you're considering either PayPal for Business or Nochex, I would have to advise you to steer well clear of both based on my experience. If you disagree and believe these two organisations sound like they really run a tight ship and can be fully trusted with your business finances, then seriously, best of luck, but if I'm your customer, I won't be paying you using either.